travel nursing tax home audit

Yes a tax home saves money that is how they can pay you more. Give us a call at 8008660407 to discuss optimizing your pay to.

How Often Do Travel Nurses Get Audited Tns

Duplicate expenses at fair market value and have proof Its not enough to just travel away from your tax home.

. Hi all Im a nursing student who hopes to do travel nursing after graduating and gaining a bit of experience. Check out our complete travel nursing deductions list. Whether it actually saves the agency money is up to interpretation.

Housing per diems and travel would not be subject to income taxes but also not subject to FICA workers comp and unemployment - reducing those costs by about 10 percent over taxable reimbursements. You cannot simply use an address of convenience. From what Ive read having a tax.

Ace an audit Its true you do have a higher chance of getting audited as a traveler. Some audits are random. If you claim a permanent tax home you must prove you are duplicating expenses if you are audited.

Your travel agency is audited and you get included in the fun. It is what you do at the end of your shift which determines if the assignment is far enough to qualify as a Travel Assignment. Episode 1 Tax Deductions.

Log In Sign Up. Due to the nature of travel nursing your expenses compared to your income can look suspicious even if theres no funny business. Having a tax home means that you pay a mortgage on a home or rent an apartment.

What can cause your tax return to be audited. Travel nursing income is not a traditional make a base pay get a W-2 position. If you return home at the end of your shift you cannot deduct miles andor meals as tax free per diem stipends.

What is a deduction and what can you use for a deduction as a Travel Nurse. Make sure to deduct any travel reimbursements from the travel nursing agency. Episode 2 Audit Triggers.

Why Travel Nurses Are at a Higher Risk of Getting Audited. Before you can even think about tax deductions its important to understand the IRS main rule when it comes to travel nursing that being you must have a tax home A tax home is defined as a permanent residence for which you incur expenses while youre working in another location. The most common circumstance is renting both places or.

This puts it in-line or above the national median wage for Registered Nurses with 5-9 years of experience. For a 1500 mile trip you can deduct 80250 Travel Nurse Tax Deduction 3. Who should be preparing your taxes.

Your agency is audited and the IRS is checking out all employees. It is wise to ask in advance what you will need as proof of a tax home so you can prepare any. As a travel nurse you may be more at risk for an audit if youre displaying high expenses and low income.

Your taxable wages are uniquely low which may raise a red-flag with the IRS. Maintaining a tax home has been a hot topic among Travel Nurses for quite some time. The way that a travel nurses income looks on paper can look.

Press question mark to learn the rest of the keyboard shortcuts. You have a lot of deductions. So be sure to consult with a tax professional for answers to specific questions about your travel nurse taxes.

In 2017 the IRS allows for write-offs at the standard mileage rate of 535 cents per mile. Travel Nurse Tax Questions Videos. You will be required to complete and sign a declaration of your permanent tax home with your travel nursing agency if you choose to take the tax-free stipends in your pay.

Your taxable wages are low enough that the IRS took notice. Essentially they are paying for their tax home and paying for housing at their new temporary residence. Youll find others who say the minimum should be 20 per hour.

In addition to the one-year rule there are other situations that are tax home killers Renting out your residence can be one. Press J to jump to the feed. The 50-mile radius is a policy set by the.

How to Prepare for a Travel Nurse IRS Audit. A tax home includes a residence where you actually live not required for your compact license. Travel Nurses actually have to prove that they are duplicating expenses.

Pin On Securecheck360 Pearson Level 2 Endpoint Assessment for Healthcare 3 from vdocumentssite. He added that agencies must have documentation of how they determined the tax-free portion of the pay packages so nurses should expect to provide expense records to their agency if requested. Im sure there are many other interpretations out there.

Here are some common reasons that you might get audited. Without a tax home all travel lodging and meal per diems allowances stipends and the value of any provided housing is taxable for the individual nurse according to Smith. RNnetwork creates custom pay packages for every travel nurse job.

One of the requirements of maintaining a tax home is that the traveler must have significant expenses in maintaining their principal residence When one rents out their home the expenses of keeping the home. The 4 Travel Nurse Tax Home Rules. Even in difficult economic times the fully blended rate for the average travel nursing contract is still somewhere between 37hour-43hour.

Travel nurses can experience tax audits at a higher rate than other positions because of the high rate of nontaxable income compared to taxable income. The story above indicates that some believe the number is 15 per hour. Meanwhile youll find tax experts focused on the travel healthcare niche who say Registered Nurses should earn a minimum of 18 per hour.

Plain old bad luck. Episode 3 Getting your Taxes Prepared. Distance is not the only qualifier for Travel Nursing stipends.

To survive a serious audit you will have to provide proof potentially including a site visit.

Furnished Finder Find Travel Nurse Housing Short Term Rentals Travel Nursing Travel Nurse Housing Nurse

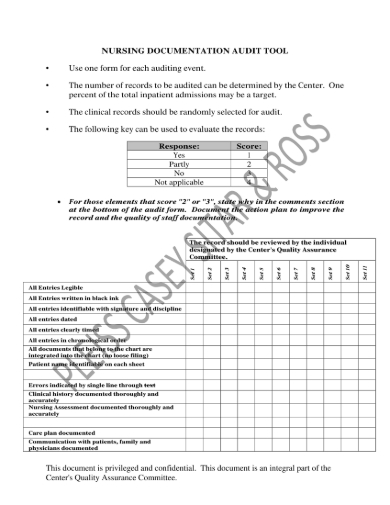

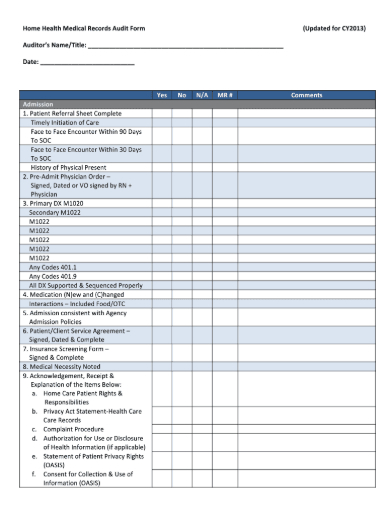

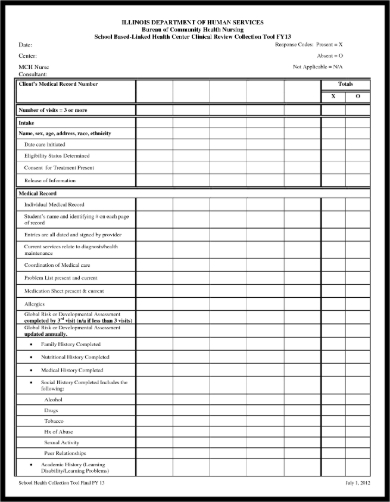

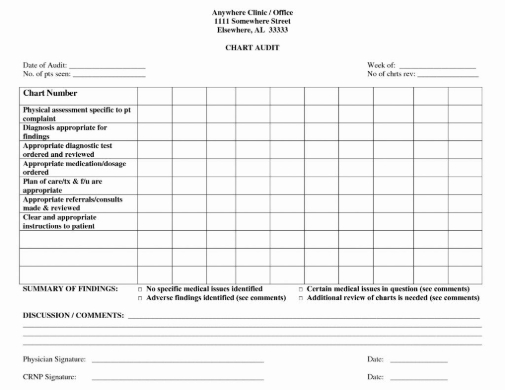

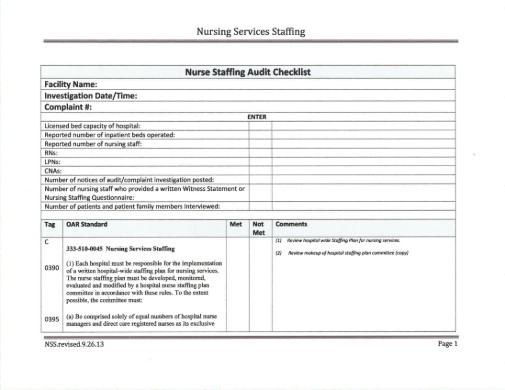

Free 5 Nursing Audit Forms In Pdf

How Often Do Travel Nurses Get Audited Tns

How Often Do Travel Nurses Get Audited Tns

Financing Investment Properties A Guide For Newbies Investing Investment In India Real Estate Investing

Free 5 Nursing Audit Forms In Pdf

Free 5 Nursing Audit Forms In Pdf

How Often Do Travel Nurses Get Audited Tns

Enhanced Recovery After Surgery And Anesthesia The Anesthesia Insider Blog Anesthesia Business Consultants Nutrition Infographic After Surgery Anesthesia

The Benefits Of Using An Irs Wichita Ks Tax Audit Representative Audit Tax Irs

Free 5 Nursing Audit Forms In Pdf

Jobs In Project Management Unit Energy Department Govt Of Punjab Energy Department Project Management Management

Travel Nurse Irs Audit Why They Occur And What To Expect

Contact Us Today To Get Your Company In The Right Position Minamargroup Com Investorrelations Mmg Gmail Com Minamargroup In 2020 Accounting Bad Debt Nursing Jobs

4 Must Know Rules To Tax Free Money As A Travel Nurse Nomadicare

Free 5 Nursing Audit Forms In Pdf

How To Survive An Irs Audit Tax Time Irs Insurance Investments

Accounting Resume Ought To Be Perfect In Any Way If You Want To Make A Resume To Be An Accounting It Is Ve Resume Objective Functional Resume Resume Examples

Business Man And Invoice Flickr Intercambio De Fotos Bookkeeping Accounting Services Bookkeeping Services