maine excise tax exemption

MAINE REVENUE SERVICES SALESEXCISE TAX DIVISION INDUSTRIAL USERS BLANKET CERTIFICATE OF EXEMPTION For purchases of Tangible Personal Property for Use in Production Under Sections 17609-D 29 30 31 32 and 74 of the Maine Sales and Use Tax Law. Automobiles owned by veterans who are granted free registration of those vehicles by the Secretary of State under.

Title 36 1482 Excise tax.

. A sum equal to 24 mills on each dollar of the makers list price for the first or current year of. 692021 - PASSED TO BE ENACTED. The following are exempt from the excise tax.

Be it enacted by the People of the State of Maine as follows. Excise Tax is an annual tax that must be paid when you are registering a vehicle. Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways.

Related

Veterans Excise Tax Exemption. The excise tax due will be 61080. AIRCRAFT HOUSE TRAILERS AND MOTOR VEHICLES.

It modifies the exemption for benevolent and charitable institutions by limiting it to only those vehicles owned by such an institution that are used solely for the institutions purposes and primarily for transporting or delivering goods to persons who have been determined to be eligible to receive. LD 1193 HP 871 An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax. Property owners would receive an exemption of 25000.

Maine LD 1430. Excise Tax is an annual tax that must be paid prior to registering your vehicle. 6551T Veterans Exemption 36 MRS.

36 MRSA 1483 sub-12 as amended by PL 2009 c. The following exemptions qualify for reimbursement. 653 Veterans Organizations 36 MRS.

For a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. Comprehensive Plan Revised 2005. An Act To Exempt Permanently Disabled Veterans from Payment of Property Tax.

I hereby claim excise tax exempt on this vessel because the vessel. Except for a few statutory exemptions all vehicles including boats registered in the State of Maine are subject to the Excise Tax. Homestead Exemption -This program provides a measure of property tax relief for certain individuals that have owned homestead property in Maine for at least 12 months and make the property they occupy on April 1 their permanent residence.

An opportunity for businesses with solar energy systems. Vehicles owned by this State or by political subdivisions of the State. This individual is permanently assigned to the unit and station identified above is on active duty and is not a member of the Guard or Reserves.

434 20 is further amended to read. Excise tax is paid at the local town office. Military Exemption From Vehicle Excise Tax City of Portland is pleased to allow exemptions for annual excise tax on vehicles owned by residents who are serving on active duty in the Armed Forces and who are permanently stationed at a military or naval post station or base outside of the State of Maine or who are deployed for military service for more than 180 days.

Active Duty Stationed In Maine Excise Tax Exemption MV-7 Antique Auto Antique Motorcycle Horseless Carriage Custom Vehicle and Street Rod Affidavit MV-65 Authorization for Registration MV-39 Disability PlatesPlacard Application PS-18 Duplicate Registration MV-11 Emergency Medical Services Plate Application MVR-17. For property tax years beginning on or after April 1 2020 the estates having a taxable situs in the place of residence of a veteran who provides to the assessor of. 691 - 700-B Homestead 36 MRS.

Maine Bureau of Veterans Services Central Office 117 State House Station Augusta ME 04333-0117. The state valuation is a basis for the allocation of money. In 2019 Maine passed bill LD 1430 which introduces a solar tax exemption for both business and residential owners enabling renewable energy adopters to save moneywhile adding real value to their property and assets.

Animal Waste Facility 36 MRS. 36 MRSA 653 sub-1 D-4 is enacted to read. 207-626-4471 Homeless Veterans Coordinator 207-446-0168 Maine Veterans Memorial Cemetery System 207-287-3481.

Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. Be it enacted by the People of the State of Maine as follows. The Property Tax Division is divided into two units.

6561J Business Equipment Tax Exemption 36 MRS. A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. 681 - 689 Snowgrooming Equipment 36 MRS.

This information is courtesy of Larry Grant City of Brewer Maine The same method will be used to calculate the fees to re-register the same vehicle. This bill amends the law that allows certain exemptions from the vehicle excise tax. MAINE DEPARTMENT OF INLAND FISHERIES AND WILDLIFE 284 State Street 41 SHS Augusta ME 04333 Phone 207-287-8000 Fax 207-287-8094.

The owner of a watercraft located in this State that is not exempt under subsection 4 shall pay an annual excise tax within 10 days of the first operation of the watercraft upon the waters of this State or prior to obtaining a certificate of number pursuant to Title 12 section 13056 or prior to July 1st whichever event first occurs based on the following. Military Exemption From Vehicle Excise Tax City of Portland is pleased to allow exemptions for annual excise tax on vehicles owned by residents who are serving on active duty in the Armed Forces and who are permanently stationed at a military or naval post station or base outside of the State of Maine or who are deployed for military service for more than 180 days. Partially exempt property tax relates to the following categories.

Sponsored by Representative Heidi Brooks. Adult Use Marijuana Licensing Ordinance. Our division is responsible for the determination of the annual equalized full value state valuation for the 484 incorporated municipalities as well as for the unorganized territory.

Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle boat or camper trailer on the public ways. Shoreland Zoning supplemental application. An Act To Exempt Certain Disabled Veterans from the Motor Vehicle Excise Tax.

Municipal Services and the Unorganized Territory. Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper trailer on the public ways. Home of Record legal address claimed for tax purposes.

WHERE DO I PAY THE EXCISE TAX. Is a lifeboat or raft carried by another vessel. For the privilege of operating a motor vehicle or camper trailer on the public ways each motor vehicle other than a stock race car or each camper trailer to be so operated is subject to excise tax as follows except as specified in subparagraph 3 4 or 5.

Form St A 119 Download Printable Pdf Or Fill Online Contractor S Exempt Purchase Certificate Maine Templateroller

100 Disabled Veterans Are Exempt From One Vehicle Excise Tax Title Fee And Drivers License Renewal Fee Greene Me

Bill Of Sale Form Maine Affidavit Of Exemption Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller

Form Stp 72 Fillable Contractors Exempt Purchase Certificate

Fillable Online Maine Industrial Users Blanket Certificate Of Exemption Form Fax Email Print Pdffiller

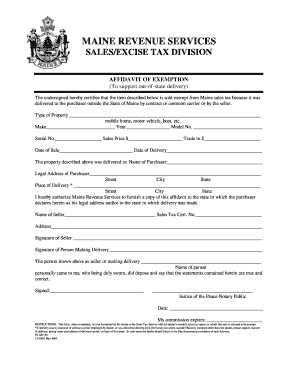

Free Maine Affidavit Of Exemption For Immediate Removal Form Pdf 35kb 1 Page S

Form St A 117 Download Printable Pdf Or Fill Online Industrial Users Blanket Certificate Of Exemption Maine Templateroller

Free Form St P 72 Contractor Exempt Purchase Certificate Free Legal Forms Laws Com

Maine Resale Certificate Pdf Fill Online Printable Fillable Blank Pdffiller

Excise Tax Information Cumberland Me

Fillable Online Maine Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form Fax Email Print Pdffiller

Bill Of Sale Form Maine Affidavit Of Exemption Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Maine Boat Excise Tax Exemption Download Fillable Pdf Templateroller

Form St A 122 Download Printable Pdf Or Fill Online Affidavit Of Exemption Products To Be Incorporated Into A New Commercial Fishing Vessel Maine Templateroller

Maine Boat Excise Tax Exemption Download Fillable Pdf Templateroller